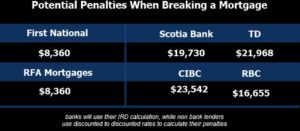

IRD penalties at banks can cost you thousands!

Non all mortgages are created equal and this is one massive example to this.

This example has all the same information inputted on all their online calculators, which are on the internet.

I started out with a mortgage amount of $450k and exactly 3 years in to the term. The remaining balance is ~$418k.

Their are multiple non bank lenders we have access to. These two examples are two of the largest in Canada. And of course there are a few more banks out there. These are a few of the largest.

When you say ‘my bank is offering me .10% difference’, I may come back and say ‘this .10% difference over the 5 years is under $2k. Do you want to spend the little more to know you are in a better product today, that may save you $11k+ later, or rish paying this later?’

This is a bit more of an extreme case, however, you can get a very good idea of how things can be different. Chasing a slightly lower rate can cost thousands here and in other areas.

This case, as well, is not an absolute resemblance of what will happen to you. It is solely for illustration purposes. There will be times when the banks penalties are the same, all depends on your remaining term, balance, and current rates at the time, to name a few

First Time Mortgage Tips, General Information, Know Your Mortgage Penalties

interest rates, mortgage penalties, mortgages